How to apply for a loan?

How to apply for a loan?

Step 1

Apply online

-

Select your loan amount

-

Enter your phone number and verify via OTP

-

Submit a short application form

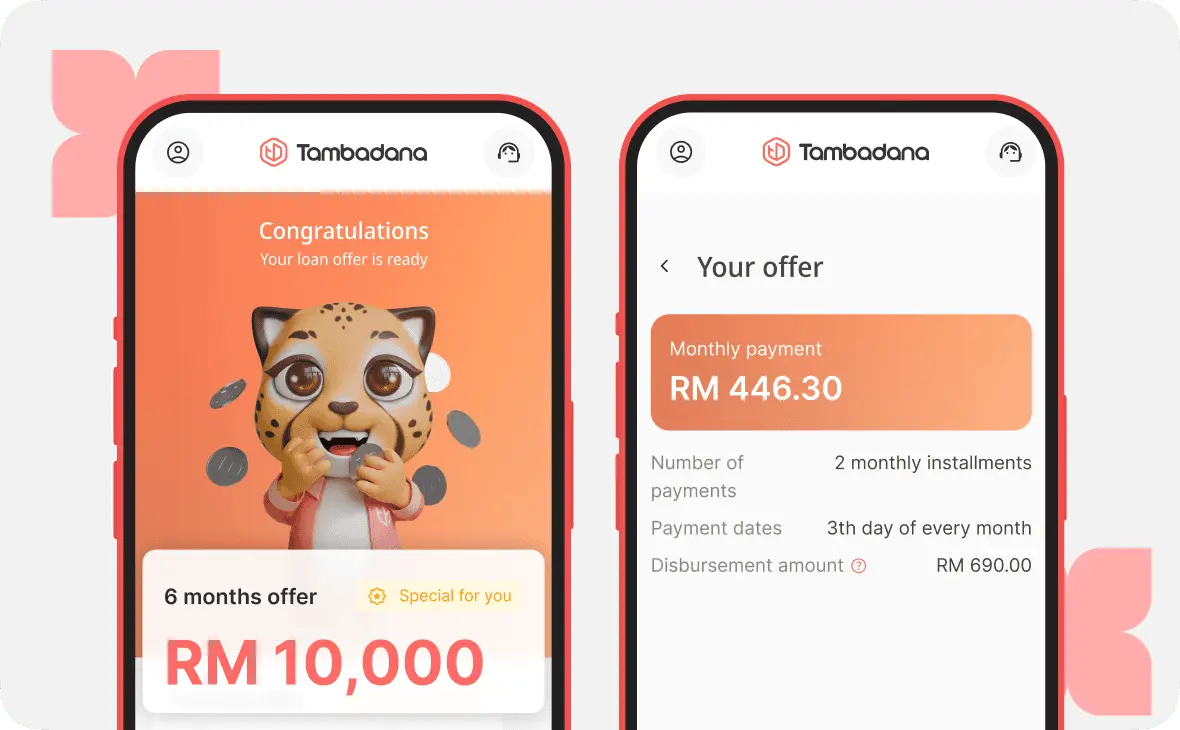

Step 2

Receive approval

-

Get approved in just 5 minutes

-

Confirm your details via a phone call if needed

Step 3

Get your money quickly

-

Receive an instant money transfer

-

Access funds from any bank account

More features in the App

-

Increased chances of approval

-

Easier way to apply and to make payments

-

More favorable conditions

-

Special offers and promotions

License

License & FAQ

Can you provide details about Tambadana's Online Personal Loan (OPL) service?

Wawasan Cojaya Sdn Bhd, with its registration number 201401047621 (1123810-P), is honored to have been selected by the Ministry of Housing and Local Government (KPKT) to provide online money lending services starting 27th March 2024, making us a prominent member of the Malaysian Credit Community. The initiative for online money lending, introduced by KPKT on 13th November 2020, responds to the public's increased demand for financial aids and the government's ambition to harness the 4.0 industrial revolution's technological advancements. Our OPL platform ensures secure and convenient financial transactions without the need for physical presence, leveraging technologies like OTP (one-time-password), e-KYC (electronic Know Your Customer), and digital certificates recognized by the Malaysian Communications and Multimedia Commission (MCMC) for borrower verification, agreement security, and data protection, fully compliant with KPKT guidelines.

Can you provide details about Tambadana's Online Personal Loan (OPL) service?

Wawasan Cojaya Sdn Bhd, with its registration number 201401047621 (1123810-P), is honored to have been selected by the Ministry of Housing and Local Government (KPKT) to provide online money lending services starting 27th March 2024, making us a prominent member of the Malaysian Credit Community. The initiative for online money lending, introduced by KPKT on 13th November 2020, responds to the public's increased demand for financial aids and the government's ambition to harness the 4.0 industrial revolution's technological advancements. Our OPL platform ensures secure and convenient financial transactions without the need for physical presence, leveraging technologies like OTP (one-time-password), e-KYC (electronic Know Your Customer), and digital certificates recognized by the Malaysian Communications and Multimedia Commission (MCMC) for borrower verification, agreement security, and data protection, fully compliant with KPKT guidelines.

Can you provide details about Tambadana's Online Personal Loan (OPL) service?

Wawasan Cojaya Sdn Bhd, with its registration number 201401047621 (1123810-P), is honored to have been selected by the Ministry of Housing and Local Government (KPKT) to provide online money lending services starting 27th March 2024, making us a prominent member of the Malaysian Credit Community. The initiative for online money lending, introduced by KPKT on 13th November 2020, responds to the public's increased demand for financial aids and the government's ambition to harness the 4.0 industrial revolution's technological advancements. Our OPL platform ensures secure and convenient financial transactions without the need for physical presence, leveraging technologies like OTP (one-time-password), e-KYC (electronic Know Your Customer), and digital certificates recognized by the Malaysian Communications and Multimedia Commission (MCMC) for borrower verification, agreement security, and data protection, fully compliant with KPKT guidelines.

Can you provide details about Tambadana's Online Personal Loan (OPL) service?

Wawasan Cojaya Sdn Bhd, with its registration number 201401047621 (1123810-P), is honored to have been selected by the Ministry of Housing and Local Government (KPKT) to provide online money lending services starting 27th March 2024, making us a prominent member of the Malaysian Credit Community. The initiative for online money lending, introduced by KPKT on 13th November 2020, responds to the public's increased demand for financial aids and the government's ambition to harness the 4.0 industrial revolution's technological advancements. Our OPL platform ensures secure and convenient financial transactions without the need for physical presence, leveraging technologies like OTP (one-time-password), e-KYC (electronic Know Your Customer), and digital certificates recognized by the Malaysian Communications and Multimedia Commission (MCMC) for borrower verification, agreement security, and data protection, fully compliant with KPKT guidelines.

Can you provide details about Tambadana's Online Personal Loan (OPL) service?

Wawasan Cojaya Sdn Bhd, with its registration number 201401047621 (1123810-P), is honored to have been selected by the Ministry of Housing and Local Government (KPKT) to provide online money lending services starting 27th March 2024, making us a prominent member of the Malaysian Credit Community. The initiative for online money lending, introduced by KPKT on 13th November 2020, responds to the public's increased demand for financial aids and the government's ambition to harness the 4.0 industrial revolution's technological advancements. Our OPL platform ensures secure and convenient financial transactions without the need for physical presence, leveraging technologies like OTP (one-time-password), e-KYC (electronic Know Your Customer), and digital certificates recognized by the Malaysian Communications and Multimedia Commission (MCMC) for borrower verification, agreement security, and data protection, fully compliant with KPKT guidelines.

Can you provide details about Tambadana's Online Personal Loan (OPL) service?

Wawasan Cojaya Sdn Bhd, with its registration number 201401047621 (1123810-P), is honored to have been selected by the Ministry of Housing and Local Government (KPKT) to provide online money lending services starting 27th March 2024, making us a prominent member of the Malaysian Credit Community. The initiative for online money lending, introduced by KPKT on 13th November 2020, responds to the public's increased demand for financial aids and the government's ambition to harness the 4.0 industrial revolution's technological advancements. Our OPL platform ensures secure and convenient financial transactions without the need for physical presence, leveraging technologies like OTP (one-time-password), e-KYC (electronic Know Your Customer), and digital certificates recognized by the Malaysian Communications and Multimedia Commission (MCMC) for borrower verification, agreement security, and data protection, fully compliant with KPKT guidelines.